Web3Educator

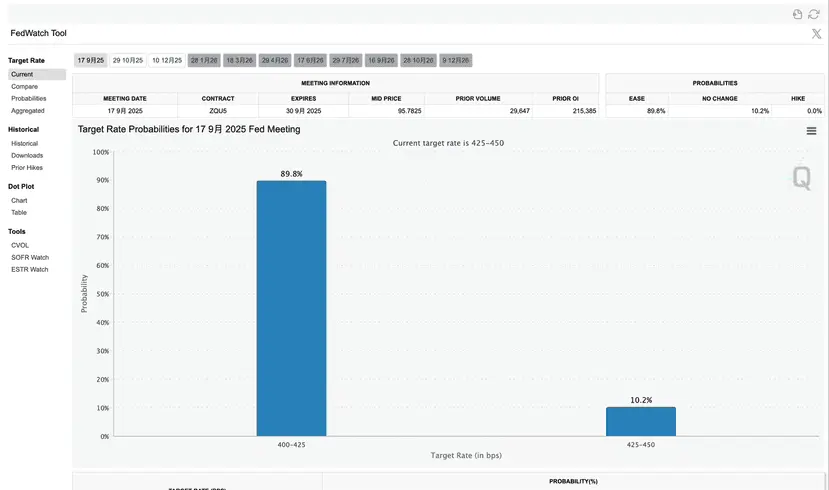

The crypto assets market has recently experienced a wave of severe fluctuation, with Bitcoin once hitting a low of $112,584, followed by a slight rebound to $112,864. Ethereum also could not escape, following the fall to $3,414. This pullback has sparked widespread attention and discussion among market participants.

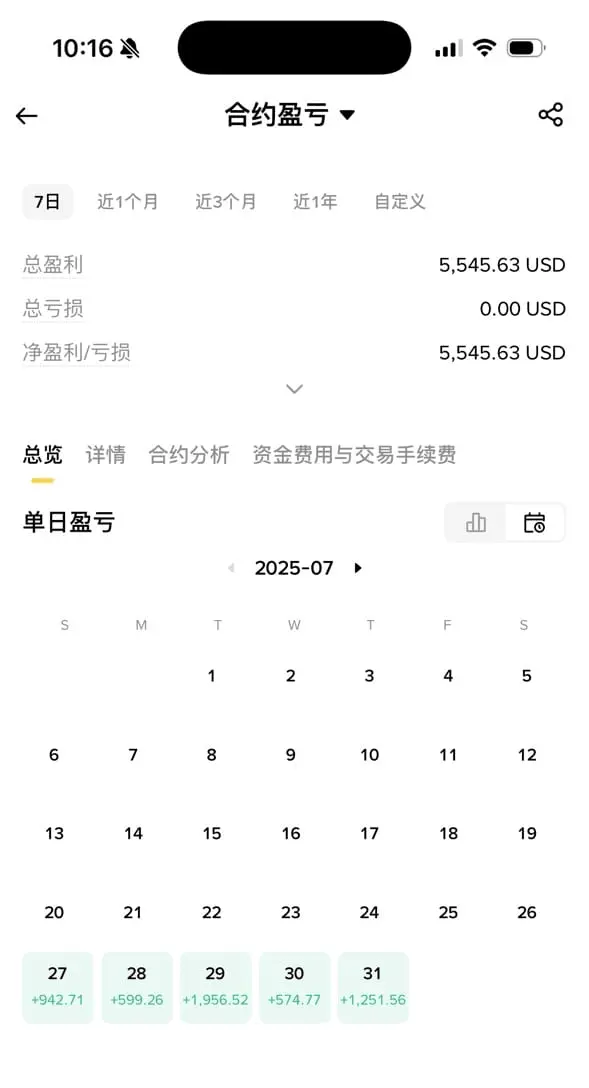

In the past 24 hours, the liquidation amount in the crypto market reached as high as $545 million, with long liquidations dominating. Such grim data seems to suggest a shift in market sentiment. Observers have noted that certain large investors have accumulated considerable floatin

View OriginalIn the past 24 hours, the liquidation amount in the crypto market reached as high as $545 million, with long liquidations dominating. Such grim data seems to suggest a shift in market sentiment. Observers have noted that certain large investors have accumulated considerable floatin