- Topic1/3

53k Popularity

38k Popularity

51k Popularity

9k Popularity

23k Popularity

- Pin

- 🎉 The #CandyDrop Futures Challenge is live — join now to share a 6 BTC prize pool!

📢 Post your futures trading experience on Gate Square with the event hashtag — $25 × 20 rewards are waiting!

🎁 $500 in futures trial vouchers up for grabs — 20 standout posts will win!

📅 Event Period: August 1, 2025, 15:00 – August 15, 2025, 19:00 (UTC+8)

👉 Event Link: https://www.gate.com/candy-drop/detail/BTC-98

Dare to trade. Dare to win.

- 🎉 Gate Square Growth Points Summer Lucky Draw Round 1️⃣ 2️⃣ Is Live!

🎁 Prize pool over $10,000! Win Huawei Mate Tri-fold Phone, F1 Red Bull Racing Car Model, exclusive Gate merch, popular tokens & more!

Try your luck now 👉 https://www.gate.com/activities/pointprize?now_period=12

How to earn Growth Points fast?

1️⃣ Go to [Square], tap the icon next to your avatar to enter [Community Center]

2️⃣ Complete daily tasks like posting, commenting, liking, and chatting to earn points

100% chance to win — prizes guaranteed! Come and draw now!

Event ends: August 9, 16:00 UTC

More details: https://www

[Forex] Euro/Yen continues analogy with one year ago | Tsune Yoshida's Forex Daily | Moneyクリ Monex Securities' investment information and media useful for money.

Euro/Yen that turned to a decline after July last year

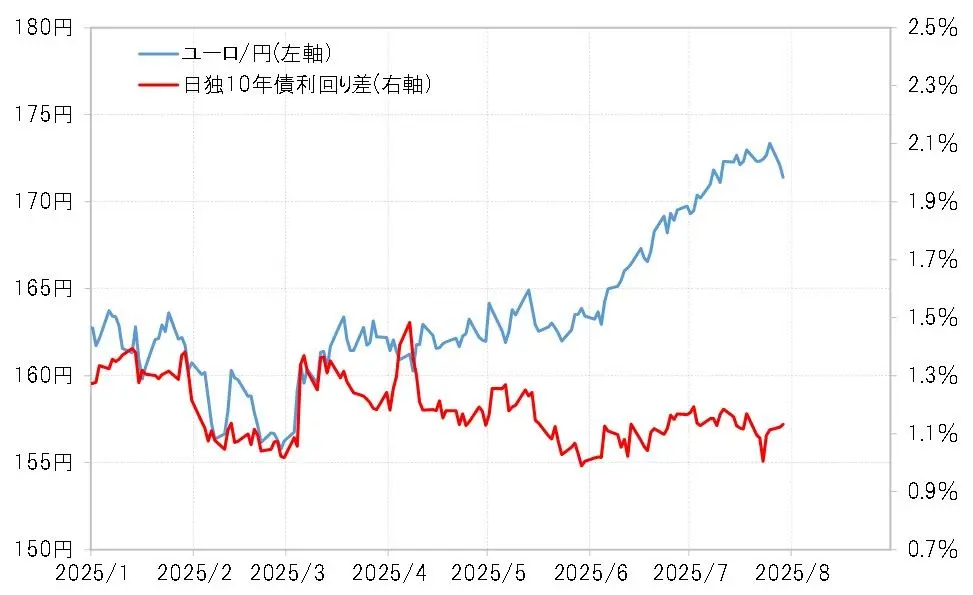

Similar price movements are also referred to as "analogy," but the Euro/Yen analogy for 2024 and 2025 diverged significantly from the Japan-Germany interest rate differential (Euro superiority, Yen inferiority) with a significant rise heading into July (see Charts 1 and 2).

[Figure 1] Euro/Yen and Japan-Germany Interest Rate Differential (From January 2025) Source: Created by Monex Securities from Refinitiv data

Source: Created by Monex Securities from Refinitiv data

[Figure 2] Euro/Yen and Japan-Germany Interest Rate Differential (January to August 2024) Source: Created by Monex Securities from data provided by Refinitiv.

The euro/yens, which rose significantly deviating from the interest rate differential in 2024, experienced a sharp reversal by August, plunging dramatically to below 160 yen, close to the levels suggested by the interest rate differential. So, why did that happen?

Source: Created by Monex Securities from data provided by Refinitiv.

The euro/yens, which rose significantly deviating from the interest rate differential in 2024, experienced a sharp reversal by August, plunging dramatically to below 160 yen, close to the levels suggested by the interest rate differential. So, why did that happen?

The Euro/Yen reversal in 2024 triggered by the USD/JPY conversion

The rise of the euro/yen at that time was largely seen as being associated with the rise of the dollar/yen. The increase in the dollar/yen was indeed significantly divorced from the Japan-U.S. interest rate differential (with the dollar being dominant and the yen being weak) (see Chart 3). Furthermore, the rise in the dollar/yen, which could not be explained by interest rate differentials, reversed following the Japanese monetary authorities' intervention to sell dollars. As the dollar/yen headed for a crash, the euro/yen also plummeted sharply, quickly closing the gap from the interest rate differential.

[Figure 3] USD/JPY and the US-Japan Interest Rate Differential (January to August 2024) Source: Created by Monex Securities based on data from Refinitiv.

The recent rise of the euro/yen may largely be led by the euro/usd rather than the dollar/yuan. Additionally, the rise of the euro/usd has significantly deviated from the German and U.S. interest rate differential (see Chart 4).

Source: Created by Monex Securities based on data from Refinitiv.

The recent rise of the euro/yen may largely be led by the euro/usd rather than the dollar/yuan. Additionally, the rise of the euro/usd has significantly deviated from the German and U.S. interest rate differential (see Chart 4).

[Figure 4] Euro/US Dollar and the German-American Interest Rate Differential (from January 2025) Source: Created by Monex Securities from Refinitiv data.

The rise of the USD/JPY, which has deviated from the interest rate differential in 2024, and the rise of the EUR/USD, which has deviated from the interest rate differential up to 2025, seem to have different reasons for their increases. The former was primarily due to a surge in speculative USD buying and JPY selling, stemming from the view that Japan's monetary authorities may no longer be able to intervene to prevent JPY appreciation. In contrast, the recent rise in EUR/USD is seen as a result of a 'dollar exodus', where the credibility of the USD has been shaken due to distrust in President Trump's policies, triggered by events such as the 'tariff shock' in April.

Source: Created by Monex Securities from Refinitiv data.

The rise of the USD/JPY, which has deviated from the interest rate differential in 2024, and the rise of the EUR/USD, which has deviated from the interest rate differential up to 2025, seem to have different reasons for their increases. The former was primarily due to a surge in speculative USD buying and JPY selling, stemming from the view that Japan's monetary authorities may no longer be able to intervene to prevent JPY appreciation. In contrast, the recent rise in EUR/USD is seen as a result of a 'dollar exodus', where the credibility of the USD has been shaken due to distrust in President Trump's policies, triggered by events such as the 'tariff shock' in April.

The speculative selling of the yen in the former case triggered a sudden intervention to sell the US dollar, which led to the bursting of the "yen selling bubble" and caused a drastic drop of about 20 yen in the USD/JPY exchange rate within a month, which also seemed to spill over to the EUR/JPY exchange rate. So, what about this time? The reversal of the EUR/JPY, which has diverged from the interest rate differential, may depend on the future direction of the EUR/USD, which has also diverged from the interest rate differential.