**歴史的な変化として、イーサリアム取引所に上場されているファンド(ETF)が、初めてビットコインETFの日次流入を上回り、6億200万ドルを引き寄せたのに対し、ビットコインは5億2300万ドルを記録した。合わせて、暗号ETFは合計11億ドルを引き寄せ、デジタル資産への機関投資家の関心を確固たるものにした。**## クリプトETFが11億ドルを引き寄せ、イーサがビットコインから注目を奪う初めて、イーサリアムのETFがビットコインのETFを日々の流入額で上回り、ETF取引活動における重要なマイルストーンを示しました。イーサリアムのファンドは6億2,020万ドルを集め、ビットコインの5億2,260万ドルをわずかに上回り、合計で暗号通貨ETFの流入が11億ドルを超える日となりました。再び、ブラックロックのETHAがイーサリアムサイドを支配し、驚異的な5億4670万ドルをもたらしました。グレイスケールのEther Mini Trustが2990万ドルで続き、フィデリティのFETHは1719万ドルを引き寄せました。少額ですが安定した流入は、BitwiseのETHW ($4.44百万)と21sharesのCETH ($3.78百万)から来ました。取引量は$2.29億のままで、イーサのETFの純資産は記録的な$17.32億に達しました。出典:SosovalueビットコインETFは、日中は他を上回ったものの、5億2260万ドルの純流入で勝利の流れを続け、11日連続のプラスの流れを記録しました。ブラックロックのIBITは4億9730万ドルで大部分を占め、フィデリティのFBTC (は783万ドル)、インベスコのBTCO (は712万ドル)、グレースケールのビットコインミニトラスト(は527万ドル)、ヴァンエックのHODL (は508万ドル)で続きました。流出は記録されませんでした。総取引量は37億6000万ドルに達し、ビットコインETFの純資産は1546億1000万ドルに増加しました。 イーサとビットコインのETF間の競争が激化する中で、明らかなことが一つある。それは、機関投資家の需要が暗号通貨の両側で繁栄しているということだ。

エーテルETFが初めてビットコインETFの日別流入を超える

歴史的な変化として、イーサリアム取引所に上場されているファンド(ETF)が、初めてビットコインETFの日次流入を上回り、6億200万ドルを引き寄せたのに対し、ビットコインは5億2300万ドルを記録した。合わせて、暗号ETFは合計11億ドルを引き寄せ、デジタル資産への機関投資家の関心を確固たるものにした。

クリプトETFが11億ドルを引き寄せ、イーサがビットコインから注目を奪う

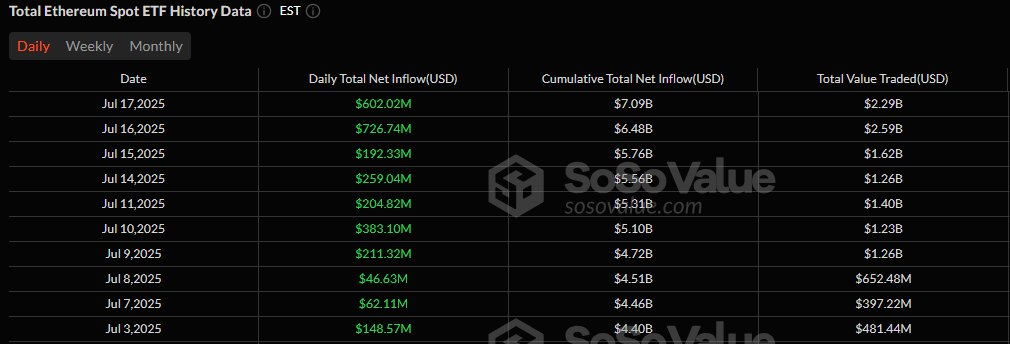

初めて、イーサリアムのETFがビットコインのETFを日々の流入額で上回り、ETF取引活動における重要なマイルストーンを示しました。イーサリアムのファンドは6億2,020万ドルを集め、ビットコインの5億2,260万ドルをわずかに上回り、合計で暗号通貨ETFの流入が11億ドルを超える日となりました。

再び、ブラックロックのETHAがイーサリアムサイドを支配し、驚異的な5億4670万ドルをもたらしました。グレイスケールのEther Mini Trustが2990万ドルで続き、フィデリティのFETHは1719万ドルを引き寄せました。

少額ですが安定した流入は、BitwiseのETHW ($4.44百万)と21sharesのCETH ($3.78百万)から来ました。取引量は$2.29億のままで、イーサのETFの純資産は記録的な$17.32億に達しました。

ブラックロックのIBITは4億9730万ドルで大部分を占め、フィデリティのFBTC (は783万ドル)、インベスコのBTCO (は712万ドル)、グレースケールのビットコインミニトラスト(は527万ドル)、ヴァンエックのHODL (は508万ドル)で続きました。流出は記録されませんでした。総取引量は37億6000万ドルに達し、ビットコインETFの純資産は1546億1000万ドルに増加しました。

イーサとビットコインのETF間の競争が激化する中で、明らかなことが一つある。それは、機関投資家の需要が暗号通貨の両側で繁栄しているということだ。